Undiscovered Equities, Inc.

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

http://www.undiscoveredequities.com/

Undiscovered Equities Top 10 2009 Average Return 168% http://www.undiscoveredequities.com/top_168.html

Undiscovered Equities is currently offering a complimentary trial subscription.

To view our newsletter on a complimentary trial basis and take advantage of our other services go to http://www.undiscoveredequities.com/ and join our email list on our home page.

Kevin McKnight 1-800-404-8982

Undiscovered Equities, Inc.

101 Plaza Real, Suite 212

Boca Raton, FL 33432

http://www.undiscoveredequities.com/

Monday, November 29, 2010

Undiscovered Equities Top 10 Picks for 2010

Undiscovered Equities, Inc.

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

http://www.undiscoveredequities.com/

As promised, we at Undiscovered Equities would like to take this opportunity to showcase our top 10 investment opportunities for 2010. Last year we urged our subscribers to ignore the nervousness of the times and take advantage of the opportunity that the period of forced liquidation created. As our results show, it proved to be, as Warren Buffett said, “one of the greatest buying opportunities of our lifetime.” Our advice to our subscribers this year is to remain patient, have a long term outlook and continue to invest in great businesses: ones that can make huge profits and grow dramatically even in today’s economic environment. Looking ahead we expect that the market for crude oil will continue to grow, especially as certain areas of the world such as India and China continue to modernize. We feel that oil prices will trade in a range between $66 and $90 per barrel. This year however we are avoiding domestic natural gas exploration plays as we believe gas prices will remain under pressure due to the recent robust shale finds and the challenging US economic environment. In the past we have focused primarily on the energy sector, but this year we have chosen to diversify as several extraordinary opportunities have captured our attention. We expect these 10 stocks to outperform in the New Year and as always it is important to keep some cash in reserves for extraordinary opportunities.

All of us at Undiscovered Equities hope you had a great holiday season and we wish you success and prosperity in the New Year!

Endeavour Financial (TSX: EDV) $1.77 Ironically, we were introduced to Endeavour through their interest in Manas Petroleum’s giant concessions in Albania. TSX Listed Endeavour Financial is an independent merchant banking company focused on the global natural resources sector. Endeavour offers advisory services in project, corporate and debt capital markets; equity financings; mergers and acquisitions; and strategic business development. Endeavour also has a gold-focused investment strategy and seeks maximum returns by identifying, investing in and consolidating junior gold mining companies as well as some oil and gas companies. Many resource investors know the Vancouver based financier Frank Giustra. Endeavour is Giustra’s most public investment vehicle and together they have been behind some of the biggest wins in the resource market this decade, including Wheaton River Gold, Northern Orion Resources and Urasia Energy. Endeavour’s track record has been impeccable, and we think they will continue to produce significant returns for their shareholders for years to come. We also feel that the continued weakness in the dollar will add to Endeavour’s success.

Environmental Infrastructure Holdings Corp. (OTC BB: EIHC) $0.26 Environmental Infrastructure Holdings (EIHC) is the parent company of various environmental manufacturing, engineering, and services companies. Currently, EIHC has two subsidiaries Equisol, LLC and Xiom Corp. as well as investments into various joint ventures and partnerships. Recognized in 2008 by INC Magazine as the 7th fastest growing private Environmental Services Company in America, Equisol, LLC, is a unique equipment solutions provider specializing in the water and wastewater industry. Their team of top rated engineers specializes in automation equipment and services across multiple industries where water use and automation are important. From consulting and design of equipment systems, to sales, installation and maintenance services, Equisol can address their customer's needs in many diverse applications. Equisol provides cost effective equipment strategies to allow users of water and producers of wastewater to achieve profitability while focusing on their core business activities. Through Equisol's association with world technology leaders, they are able to supply a broad spectrum of high quality products. Their staff, with over 300 years of engineering experience in equipment automation, uses these technologies to select the most effective solution for their customer's applications. Other recognition that Equisol has achieved include the Entrepreneur Hot 100 Fastest New Companies in 2004, INC5000 ranking of #621 for 2007, and 2009 Philadelphia 100 recognizing the fastest growing private companies in the region. Xiom Corp. is a technology business offering delivery of plastic powder coatings at on-site locations utilizing the XIOM 1000 System. Powder coating currently is a process in which metal parts are brought into a factory environment where they are cleaned and prepared to receive a powder coating. Plastic in powder form is then applied to the various metal parts by means of an electrostatic charge that causes the powder to adhere to the surface. The coated part is then heated in an oven for a period of time to cause the plastic to melt and adhere to the substrate. Although they use plastic powder, they do not electro-statically charge that powder in order for it to adhere to a substrate. Xiom uses a different mechanism which simultaneously applies and fuses the powder to a substrate. The advantage of this process is that the coating process is totally portable and can be applied anywhere, not necessarily in a factory setting, and can be applied without use of an oven to cure the coating, and can be applied to most substrates in addition to the metal substrate to which powder coatings are traditionally applied in a factory, using an oven. The CEO of the combined entities, Mr. Michael Parrish has extensive operational and general management experience; his focus is on financial performance and strategic alliances. Prior to running Equisol, Mr. Parrish held various executive positions in several General Electric Companies where he served in positions such as General Manager for global logistics and services for GE’s Water business, and, earlier, as Managing Director for GE Capital specializing in ecommerce, six sigma, and productivity of several of GE’s equipment management groups. Prior to GE, Mr. Parrish served for 14 years active duty in the U.S. Army where he held various leadership positions of increasing responsibility as an Army Aviator culminating as a member of the Army Acquisition Corps. Mr. Parrish has a Bachelor’s degree in Engineering from the U.S. Military Academy at West Point as well as a Masters degree in Astronautically Engineering from Stanford University and an MBA with honors from the Wharton School at the University of Pennsylvania. He is the current President of the West Point Society of Philadelphia and serves on the boards of the USO of SE PA/NJ and the Delaware Valley Industrial Resources Council. We think this company is extremely undervalued given the fact that the applications for Xiom's products are virtually endless. With the addition of Mike Parish and the Equisol team we believe revenues will grow dramatically in 2010.

Far East Energy Corporation (OTC BB: FEEC) $0.46 Houston, Texas based Far East Energy Corporation together with its subsidiaries, focuses on the exploration, development, production, and sale of coalbed methane gas (CBM) in the People's Republic of China. The company owns interests in three production sharing contracts, which cover the 485,000-acre Shouyang Block in Shanxi Province; the 573,000-acre Qinnan Block in Shanxi Province; and the Enhong and Laochang areas, which total 265,000 acres, in Yunnan Province. Far East Energy has formed an alliance related to its Qinnan Block with Arrow Energy International Pte Ltd (Arrow), the Singapore-based subsidiary of Arrow Energy Limited, a large Australian CBM producer. In addition Far East recently announced that gas production from the Shouyang Block in the Shouyang Block of Shanxi Province, China, has begun and is accelerating rapidly. The Shanxi project in full development has the potential to become one of the largest CBM projects in the world. In a country that desperately needs clean energy sources, Far East Energy has the potential to produce between 10 and 20 TFC of natural gas. It is also important to note that the price of natural gas in China has gone up over the last 3 years as opposed to the US where prices have plummeted. We have been following Far East for quite some time and now more than ever we are aggressive buyers.

Gran Tierra Energy Inc. (NYSE Amex: GTE, TSX: GTE) $5.74 Gran Tierra Energy, Inc. is an international oil and gas exploration and production company operating in South America. The Company currently holds interests in producing and prospective properties in Colombia, Argentina and Peru. The Company strategy is focused on establishing a portfolio of drilling opportunities to exploit undeveloped reserves to grow production, as well as undertaking exploration drilling to grow future reserves. Current production from operations exceeds 13,000 BOPD net after royalty. The Company recently announced a capital spending program of $195 million in 2010 for exploration and production that includes the drilling of seven exploration wells in Colombia, four exploration wells in Peru and re-entry and side-tracking of a well in Argentina. The approved 2010 budget also includes funds for 2-D and 3-D seismic acquisition programs in Colombia, Peru, and Argentina and facility upgrades in Colombia and Argentina. Gran Tierra Energy had $151.6 million in cash at the end of Q3 2009 and has no debt. The 2010 work program and budget is expected to be funded from cash-flow from operations with the balance from cash on hand. This is a very strong well run company and we feel they will continue to drill economic wells as they enter next year with the largest exploration drilling program in the company's history.

Houston American Energy Corp. (Nasdaq: HUSA) $6.13 Houston American Energy Corp. is an oil and gas exploration and production company whose activities are focused on several concessions in the South American country of Colombia. Houston American continues to generate strong operating cash flow from their production base in Colombia with their interest in the Hupecol project which is currently producing over 850 net barrels of oil per day and growing. In 2009, Houston American recently added 2 extremely valuable assets to their portfolio of properties. The Company partnered up with SK Energy Co. LTD to develop the highly prolific CPO 4 Block covering 345,452 acres which is situated along the productive western margin of the Llanos Basin in Colombia. Houston American now controls 25% of the CPO 4 Block which encompasses the same structure as the Corcel block where well rates of between 2,000 and 10,000 barrels of oil per day have recently been announced. SK Energy believes the CPO 4 Block has over 100 viable drilling locations with estimated recoverable reserves of 1-4 billion barrels. A 3-D seismic program is ongoing. In 2009 Houston American also inked a substantial farmout agreement with Shona Energy (Colombia) LTD. to earn a 12.5% interest in the Serrania Block, which is adjacent to the recent Ombu discovery which contains an estimated 1 billion barrels of oil in place. With the largest exploration budget in its history approved and funded Houston American enters 2010 with considerable momentum and we feel the stock will break out to new levels.

Hyperdynamics Corporation (NYSE Amex: HDY) $0.88 Sugar Land, Texas based Hyperdynamics Corporation engages in the exploration and production of oil and gas in West Africa. It holds certain contract rights for the exploration and exploitation of oil and gas in an approximately 80,000 square kilometer concession off the coast of the Republic of Guinea. The last several months have been very exciting for Hyperdynamics as they have partnered up with 2 very strong and capable companies. First Hyperdynamics signed a binding sale and purchase agreement (S&PA) with Aberdeen, Scotland, based Dana Petroleum PLC under which Dana has agreed to acquire a 23 percent participating interest in Hyperdynamics' oil and gas concession offshore the Republic of Guinea for $19.6 million. In addition Hyperdynamics has signed an agreement for exclusive dealing and letter of intent (the "LOI") with Spain's largest oil company Repsol YPF, S.A. (BMAD: REP and NYSE: REP) under which the two companies will negotiate the assignment to Repsol a 37 percent interest in Hyperdynamics' oil and gas concession offshore the Republic of Guinea for $31.5 million. Repsol also would be the operator of the Guinea project. Ray Leonard, Hyperdynamics President and Chief Executive Officer, said, "Dana Petroleum and Repsol bring significant experience to jointly explore our concession in Northwest Africa, as Repsol and Dana have successfully partnered in the past on exploration projects in Northwest Africa. "Assuming we reach definitive agreements with Repsol, Hyperdynamics will retain a 40 percent working interest in the Guinea concession and will be in a stronger financial position, with more than $51 million upon the entry into full legal effect of the production sharing contract clarification to fund our share of 3D seismic and drilling required during the exploratory period. We look forward to working with both companies to explore and develop this large, highly prospective offshore tract." If successful, we feel this company has potential to grow into a multibillion dollar company.

ICOP Digital, Inc. (Nasdaq: ICOP) $0.44 ICOP Digital, Inc. is a leading provider of mobile video solutions for Law Enforcement, Fire, EMS, Military, and Transportation markets, worldwide. ICOP solutions help the public and private sectors improve security, reduce losses, and mitigate risks through the capture, live streaming and secure management of high quality video and audio. ICOP has already penetrated law enforcement markets in 49 states, as well as key international markets, including Mexico and Saudi Arabia. ICOP Digital is currently the only approved vendor of in-car video equipment for the Kingdom of Saudi Arabia, contracted through their Ministry of Interior. We estimate the market in Saudi Arabia to be over 100,000 security vehicles and feel ICOP has great potential to capture this and other key markets in the Middle East. A few domestic clients include Alaska State Troopers, Wyoming State Troopers, Mobile Police Department in Alabama, and Hartford Police Department in Connecticut. ICOP's products have proven to be of the utmost caliber of quality in the industry, as Raytheon recently signed a 5 year agreement to sell ICOP products worldwide. We believe this to be a game changing event for the company and partnering up with Raytheon will open up significant markets to ICOP's array of products. Globally, security continues to be a major concern, and video is proving to be a key component in the growth of the security industry. We believe significant monies will be spent to modernize current systems, worldwide. Therefore, we believe 2010 will be a breakout year for ICOP.

InterOil Corporation (NYSE: IOC) $77.07 InterOil Corporation is developing a vertically integrated energy business whose primary focus is Papua New Guinea and the surrounding region. InterOil's assets consist of petroleum licenses covering about 4 million acres, an oil refinery, and retail and commercial distribution facilities, all located in Papua New Guinea. In addition, InterOil is a shareholder in a joint venture established to construct an LNG plant on a site adjacent to InterOil's refinery in Port Moresby. Congratulations to all longs as 2009 has been a truly spectacular year for the company. With 2 world record breaking wells in Antelope we wonder what Phil will do for an encore in 2010. Although the stock price has moved significantly higher we still feel there are many short and long term catalysts that will propel InterOil to new levels. Some near term examples of the upside here are possible deals announced per China, India, Japan, etc., a possible oil find announcement, further news on the proposed condensate plant, and additional analyst coverage.

Manas Petroleum (OTC BB: MNAP) $0.55 Manas Petroleum is an international oil and gas company with primary focus on exploration and development in south-eastern Europe, Central Asia and South America. Since inception, Manas has acquired a spectacular portfolio of high impact exploration properties. In keeping with their philosophy of building a strong and enduring resource base, earlier in 2009 Manas added blocks 2 and 3 in Albania, blocks 13 and 14 in Mongolia and the Western blocks in Tajikistan, expanding their portfolio from 11 to 16 blocks in 5 countries; we now believe that Manas controls in excess of 4 Billion Barrels of Recoverable Oil. Every one of the Company’s giant projects are moving forward and maturing toward production. In Albania, Manas now controls six giant exploration blocks near Europe's largest onshore production. Independent reports from Gustavson (2008) assign (P50) of 3 billion barrels in block A, B, D and E (12.3 billion barrels of oil in place). Two of Manas' original four blocks are now drill-ready. In 2009 the council of ministers ratified the production-sharing contract on the two former Oxy blocks to DWM Petroleum, a subsidiary of Manas. These blocks are within the area where most of Bankers Petroleum's current shallow oil production derives from. Manas has the rights to explore the deeper targets in block two where Bankers is producing oil, and where in 2001 Occidental made a light oil discovery. In November Manas entered into a letter of intent to spin off a portion of its interest in its Albanian project to a TSX-V listed company WWI Resources ("WWI") which is controlled by one of the largest and most successful North American resource investors, Frank Giustra. We believe this is an excellent transaction for Manas as it will create significant shareholder value moving forward. The closing is expected to be completed during the first several weeks of the New Year. In Kyrgyzstan, Manas has signed a $54 million USD farm-out agreement with Santos LTD ADR, covering 1.2 billion barrels in place (Scott Pickford, 2005). Santos will continue to drill with Manas on their 6 shallow and deep well program in 2010. Manas' Development of its license in Tajikistan is now covered by an option farm-in agreement with Santos, where a seismic program is moving forward. In Mongolia Manas will expand their exploration with a seismic campaign to encompass approximately 20, 000 square kilometers. Additionally, to expose Manas to a much larger and more sophisticated audience, the Company is continuing to take the necessary steps to become listed on the TSX Venture stock exchange. Importantly, next year looks set to see a very significant acceleration of Manas Petroleum’s activities and surely this company has the greatest upside potential on our list.

Nutra Pharma Corporation (OTC BB: NPHC) $0.35 Nutra Pharma Corporation was founded in 2000 and is based in Plantation, Florida. The company, through its subsidiaries, operates as a biotechnology company specializing in the acquisition, licensing, and commercialization of pharmaceutical products and technologies for the management of neurological disorders, cancer, pain, autoimmune, and infectious diseases. Nutra Pharma's wholly-owned drug discovery subsidiary, ReceptoPharm, is developing proprietary therapeutic protein products primarily for the prevention and treatment of viral and neurological diseases, including Multiple Sclerosis (MS), Adrenomyeloneuropathy (AMN), and Human Immunodeficiency Virus (HIV), and pain in humans. Additionally, ReceptoPharm provides contract research services through its ISO class 5 and GMP certified facilities. The Company recently launched an Over-The-Counter (OTC) Treatment for Stage 2 (Moderate to Severe) Chronic Pain called Cobroxin. Cobroxin is the first OTC pain reliever clinically proven to treat Stage 2 (moderate to severe) chronic pain and is available as an oral spray for treating lower back pain, migraines, neck aches, shoulder pain, cramps and neuralgia and as a topical gel for treating repetitive stress, arthritis, and joint pain. Nutra Pharma also has formulated a higher dose pharmaceutical grade treatment for stage 3 (severe) pain called Nyloxin. Nyloxin Oral Spray is an oral formulation of diluted cobra venom prepared according to the requirements of the Homeopathic Pharmacopoeia of the United States (HPUS) and its supporting texts. What really drew us to this company is the exceptional management team lead by CEO Rik J Deitsch. With sales of Cobroxin ramping up, Nutra Pharma appears to be well on the way to becoming a major success. Undiscovered Equities is currently offering a complimentary trial subscription.

To view our newsletter on a complimentary trial basis and take advantage of our other services go to http://www.undiscoveredequities.com/ and join our email list on our home page.

Kevin McKnight 1-800-404-8982

Undiscovered Equities, Inc.

101 Plaza Real, Suite 212 Boca Raton, FL 33432

http://www.undiscoveredequities.com/

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

http://www.undiscoveredequities.com/

As promised, we at Undiscovered Equities would like to take this opportunity to showcase our top 10 investment opportunities for 2010. Last year we urged our subscribers to ignore the nervousness of the times and take advantage of the opportunity that the period of forced liquidation created. As our results show, it proved to be, as Warren Buffett said, “one of the greatest buying opportunities of our lifetime.” Our advice to our subscribers this year is to remain patient, have a long term outlook and continue to invest in great businesses: ones that can make huge profits and grow dramatically even in today’s economic environment. Looking ahead we expect that the market for crude oil will continue to grow, especially as certain areas of the world such as India and China continue to modernize. We feel that oil prices will trade in a range between $66 and $90 per barrel. This year however we are avoiding domestic natural gas exploration plays as we believe gas prices will remain under pressure due to the recent robust shale finds and the challenging US economic environment. In the past we have focused primarily on the energy sector, but this year we have chosen to diversify as several extraordinary opportunities have captured our attention. We expect these 10 stocks to outperform in the New Year and as always it is important to keep some cash in reserves for extraordinary opportunities.

All of us at Undiscovered Equities hope you had a great holiday season and we wish you success and prosperity in the New Year!

Endeavour Financial (TSX: EDV) $1.77 Ironically, we were introduced to Endeavour through their interest in Manas Petroleum’s giant concessions in Albania. TSX Listed Endeavour Financial is an independent merchant banking company focused on the global natural resources sector. Endeavour offers advisory services in project, corporate and debt capital markets; equity financings; mergers and acquisitions; and strategic business development. Endeavour also has a gold-focused investment strategy and seeks maximum returns by identifying, investing in and consolidating junior gold mining companies as well as some oil and gas companies. Many resource investors know the Vancouver based financier Frank Giustra. Endeavour is Giustra’s most public investment vehicle and together they have been behind some of the biggest wins in the resource market this decade, including Wheaton River Gold, Northern Orion Resources and Urasia Energy. Endeavour’s track record has been impeccable, and we think they will continue to produce significant returns for their shareholders for years to come. We also feel that the continued weakness in the dollar will add to Endeavour’s success.

Environmental Infrastructure Holdings Corp. (OTC BB: EIHC) $0.26 Environmental Infrastructure Holdings (EIHC) is the parent company of various environmental manufacturing, engineering, and services companies. Currently, EIHC has two subsidiaries Equisol, LLC and Xiom Corp. as well as investments into various joint ventures and partnerships. Recognized in 2008 by INC Magazine as the 7th fastest growing private Environmental Services Company in America, Equisol, LLC, is a unique equipment solutions provider specializing in the water and wastewater industry. Their team of top rated engineers specializes in automation equipment and services across multiple industries where water use and automation are important. From consulting and design of equipment systems, to sales, installation and maintenance services, Equisol can address their customer's needs in many diverse applications. Equisol provides cost effective equipment strategies to allow users of water and producers of wastewater to achieve profitability while focusing on their core business activities. Through Equisol's association with world technology leaders, they are able to supply a broad spectrum of high quality products. Their staff, with over 300 years of engineering experience in equipment automation, uses these technologies to select the most effective solution for their customer's applications. Other recognition that Equisol has achieved include the Entrepreneur Hot 100 Fastest New Companies in 2004, INC5000 ranking of #621 for 2007, and 2009 Philadelphia 100 recognizing the fastest growing private companies in the region. Xiom Corp. is a technology business offering delivery of plastic powder coatings at on-site locations utilizing the XIOM 1000 System. Powder coating currently is a process in which metal parts are brought into a factory environment where they are cleaned and prepared to receive a powder coating. Plastic in powder form is then applied to the various metal parts by means of an electrostatic charge that causes the powder to adhere to the surface. The coated part is then heated in an oven for a period of time to cause the plastic to melt and adhere to the substrate. Although they use plastic powder, they do not electro-statically charge that powder in order for it to adhere to a substrate. Xiom uses a different mechanism which simultaneously applies and fuses the powder to a substrate. The advantage of this process is that the coating process is totally portable and can be applied anywhere, not necessarily in a factory setting, and can be applied without use of an oven to cure the coating, and can be applied to most substrates in addition to the metal substrate to which powder coatings are traditionally applied in a factory, using an oven. The CEO of the combined entities, Mr. Michael Parrish has extensive operational and general management experience; his focus is on financial performance and strategic alliances. Prior to running Equisol, Mr. Parrish held various executive positions in several General Electric Companies where he served in positions such as General Manager for global logistics and services for GE’s Water business, and, earlier, as Managing Director for GE Capital specializing in ecommerce, six sigma, and productivity of several of GE’s equipment management groups. Prior to GE, Mr. Parrish served for 14 years active duty in the U.S. Army where he held various leadership positions of increasing responsibility as an Army Aviator culminating as a member of the Army Acquisition Corps. Mr. Parrish has a Bachelor’s degree in Engineering from the U.S. Military Academy at West Point as well as a Masters degree in Astronautically Engineering from Stanford University and an MBA with honors from the Wharton School at the University of Pennsylvania. He is the current President of the West Point Society of Philadelphia and serves on the boards of the USO of SE PA/NJ and the Delaware Valley Industrial Resources Council. We think this company is extremely undervalued given the fact that the applications for Xiom's products are virtually endless. With the addition of Mike Parish and the Equisol team we believe revenues will grow dramatically in 2010.

Far East Energy Corporation (OTC BB: FEEC) $0.46 Houston, Texas based Far East Energy Corporation together with its subsidiaries, focuses on the exploration, development, production, and sale of coalbed methane gas (CBM) in the People's Republic of China. The company owns interests in three production sharing contracts, which cover the 485,000-acre Shouyang Block in Shanxi Province; the 573,000-acre Qinnan Block in Shanxi Province; and the Enhong and Laochang areas, which total 265,000 acres, in Yunnan Province. Far East Energy has formed an alliance related to its Qinnan Block with Arrow Energy International Pte Ltd (Arrow), the Singapore-based subsidiary of Arrow Energy Limited, a large Australian CBM producer. In addition Far East recently announced that gas production from the Shouyang Block in the Shouyang Block of Shanxi Province, China, has begun and is accelerating rapidly. The Shanxi project in full development has the potential to become one of the largest CBM projects in the world. In a country that desperately needs clean energy sources, Far East Energy has the potential to produce between 10 and 20 TFC of natural gas. It is also important to note that the price of natural gas in China has gone up over the last 3 years as opposed to the US where prices have plummeted. We have been following Far East for quite some time and now more than ever we are aggressive buyers.

Gran Tierra Energy Inc. (NYSE Amex: GTE, TSX: GTE) $5.74 Gran Tierra Energy, Inc. is an international oil and gas exploration and production company operating in South America. The Company currently holds interests in producing and prospective properties in Colombia, Argentina and Peru. The Company strategy is focused on establishing a portfolio of drilling opportunities to exploit undeveloped reserves to grow production, as well as undertaking exploration drilling to grow future reserves. Current production from operations exceeds 13,000 BOPD net after royalty. The Company recently announced a capital spending program of $195 million in 2010 for exploration and production that includes the drilling of seven exploration wells in Colombia, four exploration wells in Peru and re-entry and side-tracking of a well in Argentina. The approved 2010 budget also includes funds for 2-D and 3-D seismic acquisition programs in Colombia, Peru, and Argentina and facility upgrades in Colombia and Argentina. Gran Tierra Energy had $151.6 million in cash at the end of Q3 2009 and has no debt. The 2010 work program and budget is expected to be funded from cash-flow from operations with the balance from cash on hand. This is a very strong well run company and we feel they will continue to drill economic wells as they enter next year with the largest exploration drilling program in the company's history.

Houston American Energy Corp. (Nasdaq: HUSA) $6.13 Houston American Energy Corp. is an oil and gas exploration and production company whose activities are focused on several concessions in the South American country of Colombia. Houston American continues to generate strong operating cash flow from their production base in Colombia with their interest in the Hupecol project which is currently producing over 850 net barrels of oil per day and growing. In 2009, Houston American recently added 2 extremely valuable assets to their portfolio of properties. The Company partnered up with SK Energy Co. LTD to develop the highly prolific CPO 4 Block covering 345,452 acres which is situated along the productive western margin of the Llanos Basin in Colombia. Houston American now controls 25% of the CPO 4 Block which encompasses the same structure as the Corcel block where well rates of between 2,000 and 10,000 barrels of oil per day have recently been announced. SK Energy believes the CPO 4 Block has over 100 viable drilling locations with estimated recoverable reserves of 1-4 billion barrels. A 3-D seismic program is ongoing. In 2009 Houston American also inked a substantial farmout agreement with Shona Energy (Colombia) LTD. to earn a 12.5% interest in the Serrania Block, which is adjacent to the recent Ombu discovery which contains an estimated 1 billion barrels of oil in place. With the largest exploration budget in its history approved and funded Houston American enters 2010 with considerable momentum and we feel the stock will break out to new levels.

Hyperdynamics Corporation (NYSE Amex: HDY) $0.88 Sugar Land, Texas based Hyperdynamics Corporation engages in the exploration and production of oil and gas in West Africa. It holds certain contract rights for the exploration and exploitation of oil and gas in an approximately 80,000 square kilometer concession off the coast of the Republic of Guinea. The last several months have been very exciting for Hyperdynamics as they have partnered up with 2 very strong and capable companies. First Hyperdynamics signed a binding sale and purchase agreement (S&PA) with Aberdeen, Scotland, based Dana Petroleum PLC under which Dana has agreed to acquire a 23 percent participating interest in Hyperdynamics' oil and gas concession offshore the Republic of Guinea for $19.6 million. In addition Hyperdynamics has signed an agreement for exclusive dealing and letter of intent (the "LOI") with Spain's largest oil company Repsol YPF, S.A. (BMAD: REP and NYSE: REP) under which the two companies will negotiate the assignment to Repsol a 37 percent interest in Hyperdynamics' oil and gas concession offshore the Republic of Guinea for $31.5 million. Repsol also would be the operator of the Guinea project. Ray Leonard, Hyperdynamics President and Chief Executive Officer, said, "Dana Petroleum and Repsol bring significant experience to jointly explore our concession in Northwest Africa, as Repsol and Dana have successfully partnered in the past on exploration projects in Northwest Africa. "Assuming we reach definitive agreements with Repsol, Hyperdynamics will retain a 40 percent working interest in the Guinea concession and will be in a stronger financial position, with more than $51 million upon the entry into full legal effect of the production sharing contract clarification to fund our share of 3D seismic and drilling required during the exploratory period. We look forward to working with both companies to explore and develop this large, highly prospective offshore tract." If successful, we feel this company has potential to grow into a multibillion dollar company.

ICOP Digital, Inc. (Nasdaq: ICOP) $0.44 ICOP Digital, Inc. is a leading provider of mobile video solutions for Law Enforcement, Fire, EMS, Military, and Transportation markets, worldwide. ICOP solutions help the public and private sectors improve security, reduce losses, and mitigate risks through the capture, live streaming and secure management of high quality video and audio. ICOP has already penetrated law enforcement markets in 49 states, as well as key international markets, including Mexico and Saudi Arabia. ICOP Digital is currently the only approved vendor of in-car video equipment for the Kingdom of Saudi Arabia, contracted through their Ministry of Interior. We estimate the market in Saudi Arabia to be over 100,000 security vehicles and feel ICOP has great potential to capture this and other key markets in the Middle East. A few domestic clients include Alaska State Troopers, Wyoming State Troopers, Mobile Police Department in Alabama, and Hartford Police Department in Connecticut. ICOP's products have proven to be of the utmost caliber of quality in the industry, as Raytheon recently signed a 5 year agreement to sell ICOP products worldwide. We believe this to be a game changing event for the company and partnering up with Raytheon will open up significant markets to ICOP's array of products. Globally, security continues to be a major concern, and video is proving to be a key component in the growth of the security industry. We believe significant monies will be spent to modernize current systems, worldwide. Therefore, we believe 2010 will be a breakout year for ICOP.

InterOil Corporation (NYSE: IOC) $77.07 InterOil Corporation is developing a vertically integrated energy business whose primary focus is Papua New Guinea and the surrounding region. InterOil's assets consist of petroleum licenses covering about 4 million acres, an oil refinery, and retail and commercial distribution facilities, all located in Papua New Guinea. In addition, InterOil is a shareholder in a joint venture established to construct an LNG plant on a site adjacent to InterOil's refinery in Port Moresby. Congratulations to all longs as 2009 has been a truly spectacular year for the company. With 2 world record breaking wells in Antelope we wonder what Phil will do for an encore in 2010. Although the stock price has moved significantly higher we still feel there are many short and long term catalysts that will propel InterOil to new levels. Some near term examples of the upside here are possible deals announced per China, India, Japan, etc., a possible oil find announcement, further news on the proposed condensate plant, and additional analyst coverage.

Manas Petroleum (OTC BB: MNAP) $0.55 Manas Petroleum is an international oil and gas company with primary focus on exploration and development in south-eastern Europe, Central Asia and South America. Since inception, Manas has acquired a spectacular portfolio of high impact exploration properties. In keeping with their philosophy of building a strong and enduring resource base, earlier in 2009 Manas added blocks 2 and 3 in Albania, blocks 13 and 14 in Mongolia and the Western blocks in Tajikistan, expanding their portfolio from 11 to 16 blocks in 5 countries; we now believe that Manas controls in excess of 4 Billion Barrels of Recoverable Oil. Every one of the Company’s giant projects are moving forward and maturing toward production. In Albania, Manas now controls six giant exploration blocks near Europe's largest onshore production. Independent reports from Gustavson (2008) assign (P50) of 3 billion barrels in block A, B, D and E (12.3 billion barrels of oil in place). Two of Manas' original four blocks are now drill-ready. In 2009 the council of ministers ratified the production-sharing contract on the two former Oxy blocks to DWM Petroleum, a subsidiary of Manas. These blocks are within the area where most of Bankers Petroleum's current shallow oil production derives from. Manas has the rights to explore the deeper targets in block two where Bankers is producing oil, and where in 2001 Occidental made a light oil discovery. In November Manas entered into a letter of intent to spin off a portion of its interest in its Albanian project to a TSX-V listed company WWI Resources ("WWI") which is controlled by one of the largest and most successful North American resource investors, Frank Giustra. We believe this is an excellent transaction for Manas as it will create significant shareholder value moving forward. The closing is expected to be completed during the first several weeks of the New Year. In Kyrgyzstan, Manas has signed a $54 million USD farm-out agreement with Santos LTD ADR, covering 1.2 billion barrels in place (Scott Pickford, 2005). Santos will continue to drill with Manas on their 6 shallow and deep well program in 2010. Manas' Development of its license in Tajikistan is now covered by an option farm-in agreement with Santos, where a seismic program is moving forward. In Mongolia Manas will expand their exploration with a seismic campaign to encompass approximately 20, 000 square kilometers. Additionally, to expose Manas to a much larger and more sophisticated audience, the Company is continuing to take the necessary steps to become listed on the TSX Venture stock exchange. Importantly, next year looks set to see a very significant acceleration of Manas Petroleum’s activities and surely this company has the greatest upside potential on our list.

Nutra Pharma Corporation (OTC BB: NPHC) $0.35 Nutra Pharma Corporation was founded in 2000 and is based in Plantation, Florida. The company, through its subsidiaries, operates as a biotechnology company specializing in the acquisition, licensing, and commercialization of pharmaceutical products and technologies for the management of neurological disorders, cancer, pain, autoimmune, and infectious diseases. Nutra Pharma's wholly-owned drug discovery subsidiary, ReceptoPharm, is developing proprietary therapeutic protein products primarily for the prevention and treatment of viral and neurological diseases, including Multiple Sclerosis (MS), Adrenomyeloneuropathy (AMN), and Human Immunodeficiency Virus (HIV), and pain in humans. Additionally, ReceptoPharm provides contract research services through its ISO class 5 and GMP certified facilities. The Company recently launched an Over-The-Counter (OTC) Treatment for Stage 2 (Moderate to Severe) Chronic Pain called Cobroxin. Cobroxin is the first OTC pain reliever clinically proven to treat Stage 2 (moderate to severe) chronic pain and is available as an oral spray for treating lower back pain, migraines, neck aches, shoulder pain, cramps and neuralgia and as a topical gel for treating repetitive stress, arthritis, and joint pain. Nutra Pharma also has formulated a higher dose pharmaceutical grade treatment for stage 3 (severe) pain called Nyloxin. Nyloxin Oral Spray is an oral formulation of diluted cobra venom prepared according to the requirements of the Homeopathic Pharmacopoeia of the United States (HPUS) and its supporting texts. What really drew us to this company is the exceptional management team lead by CEO Rik J Deitsch. With sales of Cobroxin ramping up, Nutra Pharma appears to be well on the way to becoming a major success. Undiscovered Equities is currently offering a complimentary trial subscription.

To view our newsletter on a complimentary trial basis and take advantage of our other services go to http://www.undiscoveredequities.com/ and join our email list on our home page.

Kevin McKnight 1-800-404-8982

Undiscovered Equities, Inc.

101 Plaza Real, Suite 212 Boca Raton, FL 33432

http://www.undiscoveredequities.com/

Wednesday, November 17, 2010

HOUSTON AMERICAN ENERGY ANNOUNCES COMPLETION OF SALE OF KARNES COUNTY, TEXAS ASSETS

Sale Price Increased to Include Overriding Royalty Interest

Houston, Texas – November 17, 2010 -- Houston American Energy Corp. (NYSEAmex: HUSA) today announced that it has closed the previously announced sale to Plains Exploration & Production Company of oil and gas properties in the Eagle Ford oil and gas condensate windows in Karnes County, Texas.

As part of the transaction Houston American Energy agreed to sell all of its working and overriding royalty interest. The final purchase and sale price of the interests sold by Houston American was approximately $4.1 million gross, which amount is subject to customary post-closing adjustments and withholdings related to the transaction.

About Houston American Energy Corp.

Based in Houston, Texas, Houston American Energy Corp. is an independent energy company with interests in oil and natural gas wells and prospects. The company's business strategy includes a property mix of producing and non-producing assets with a focus on Colombia, Texas and Louisiana. Additional information can be accessed by reviewing our Form 10-Q and other periodic reports filed with the Securities and Exchange Commission which can be found on our website at www.houstonamericanenergy.com.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

Houston, Texas – November 17, 2010 -- Houston American Energy Corp. (NYSEAmex: HUSA) today announced that it has closed the previously announced sale to Plains Exploration & Production Company of oil and gas properties in the Eagle Ford oil and gas condensate windows in Karnes County, Texas.

As part of the transaction Houston American Energy agreed to sell all of its working and overriding royalty interest. The final purchase and sale price of the interests sold by Houston American was approximately $4.1 million gross, which amount is subject to customary post-closing adjustments and withholdings related to the transaction.

About Houston American Energy Corp.

Based in Houston, Texas, Houston American Energy Corp. is an independent energy company with interests in oil and natural gas wells and prospects. The company's business strategy includes a property mix of producing and non-producing assets with a focus on Colombia, Texas and Louisiana. Additional information can be accessed by reviewing our Form 10-Q and other periodic reports filed with the Securities and Exchange Commission which can be found on our website at www.houstonamericanenergy.com.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

CTi & Desmet Ballestra Expand Worldwide Exclusive Technology License & Distribution Arrangement and Announce Roll-Out of New Technology

LOS ANGELES, Nov. 17, 2010-- Cavitation Technologies, Inc. (CTi) (OTC Bulletin Board:CVAT.ob - News). CTi announced today that n.v. Desmet Ballestra Group s.a. (Desmet) and CTi have entered into a new global technology license, marketing and collaboration agreement with respect to CTi's proprietary Nano Reactor™ technology. The new agreement replaces the worldwide license and distribution agreement signed by the parties in January 2010 and substantially expands the license and authority that Desmet will have in marketing CTi's nano reactor technology in the field of vegetable oil treatment, processing and refining.

The new agreement follows months of testing and evaluating "pilot" nano reactor systems installed by CTi and Desmet at U.S. vegetable oil refining facilities. This program confirmed the potential value of CTi's Nano Neutralization™ process, a new commercial application of CTi's technology geared to certain vegetable oil refining processes.

According to Roman Gordon, CTi's CEO, "Data from our pilot program allowed us to measure the economic benefits Nano Neutralization can generate for oil refiners. Based on these results, we realized immediately the importance of expanding our relationship with Desmet in order to make our technology available to the vegetable oil refining industry on a worldwide basis. We believe that, as one of the world's leading engineering firms in the design and construction of processing and refining systems in the natural oils and fats industry, Desmet is uniquely positioned to assist CTi in developing and marketing our nano reactor technology in this area."

Under the new agreement, Desmet has been granted a worldwide exclusive license to design, install and integrate into vegetable oil refineries nano reactor systems that will deploy the Nano Neutralization™ process and other liquid processing solutions developed for the oils and fats industry. CTi and Desmet are currently in the process of rolling out a marketing program that will make the Nano Neutralization™ process available to vegetable oil refiners in the U.S., Europe and in South and America.

CTi is a technology research and development company engaged primarily in the development of environmentally clean Nano Reactor™ technologies and liquids processing applications and solutions in various fields and industries, including natural plant (vegetable) oil processing and refining; renewable fuels; petroleum refining and petrochemicals; water and wastewater treatment; and the food and beverage industries. For additional information please visit: www.ctinanotech.com.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

The new agreement follows months of testing and evaluating "pilot" nano reactor systems installed by CTi and Desmet at U.S. vegetable oil refining facilities. This program confirmed the potential value of CTi's Nano Neutralization™ process, a new commercial application of CTi's technology geared to certain vegetable oil refining processes.

According to Roman Gordon, CTi's CEO, "Data from our pilot program allowed us to measure the economic benefits Nano Neutralization can generate for oil refiners. Based on these results, we realized immediately the importance of expanding our relationship with Desmet in order to make our technology available to the vegetable oil refining industry on a worldwide basis. We believe that, as one of the world's leading engineering firms in the design and construction of processing and refining systems in the natural oils and fats industry, Desmet is uniquely positioned to assist CTi in developing and marketing our nano reactor technology in this area."

Under the new agreement, Desmet has been granted a worldwide exclusive license to design, install and integrate into vegetable oil refineries nano reactor systems that will deploy the Nano Neutralization™ process and other liquid processing solutions developed for the oils and fats industry. CTi and Desmet are currently in the process of rolling out a marketing program that will make the Nano Neutralization™ process available to vegetable oil refiners in the U.S., Europe and in South and America.

CTi is a technology research and development company engaged primarily in the development of environmentally clean Nano Reactor™ technologies and liquids processing applications and solutions in various fields and industries, including natural plant (vegetable) oil processing and refining; renewable fuels; petroleum refining and petrochemicals; water and wastewater treatment; and the food and beverage industries. For additional information please visit: www.ctinanotech.com.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

Tuesday, November 16, 2010

CTi Receives 'CE' Marking Certificate Paving Way for Company's Expansion to EU

LOS ANGELES, Nov. 16, 2010 Cavitation Technologies, Inc. (CTi) (OTC Bulletin Board: CVAT; Frankfurt/Berlin/Stuttgart: WTC): CTi has received a Certificate and Declaration of Conformity of CE Marking from European based Barclay-Phelps, creating another important milestone for CTi and allowing the company to market its nano reactor in the European Union (EU). With the award of the prestigious "CE" marking, CTi's five different models of its NanoReactors(TM) comply with European Economic Area (EEA) requirements. The Certificate classifies the reactors within a European Directive that will allow CTi to bypass multiple local approvals in each EU member state, making it easier for CTi to access EU markets. The EU market has a spending power that has been reputed to be greater than that of the United States or Japan.

CTi and Desmet Ballestra Group S.A (www.desmetgroup.com) greeted the news with enthusiasm. On January 20, 2010, Desmet Ballestra, a European based conglomerate and worldwide leader in the design and delivery of advanced processing systems for vegetable (edible) oil extraction and refining facilities throughout the world, has entered into a worldwide licensing and distribution agreement with CTi. The Certificate is seen as yet another positive development that will accelerate the commercialization of CTi's NanoReactor(TM) technology in Europe and allow CTi and Desmet to make Nano Neutralization(TM) available to the vegetable oil refining industry on a worldwide basis.

CTi's Certificate notes that its five approved NanoReactors(TM) conform with test results confirmed by the U.S.-based laboratory's testing facility. F-Squared Laboratories, which conducted the tests, claims to have a management team with over 100 years of combined experience in EMC/Safety testing, RF, quality, design, and certifications. The Certificate was signed by CTi's CEO Roman Gordon on November 10th.

About CTi

CTi (OTCBB: CVAT; Frankfurt, Berlin & Stuttgart: WTC) is a technology research, development and technology company engaged primarily in the development of environmentally clean NanoReactor(TM) technologies and liquid process applications and solutions in various fields and industries, including vegetable oil processing and refining; renewable fuels; petroleum refining and petrochemicals; water and wastewater treatment; and the food and beverage industries.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

CTi and Desmet Ballestra Group S.A (www.desmetgroup.com) greeted the news with enthusiasm. On January 20, 2010, Desmet Ballestra, a European based conglomerate and worldwide leader in the design and delivery of advanced processing systems for vegetable (edible) oil extraction and refining facilities throughout the world, has entered into a worldwide licensing and distribution agreement with CTi. The Certificate is seen as yet another positive development that will accelerate the commercialization of CTi's NanoReactor(TM) technology in Europe and allow CTi and Desmet to make Nano Neutralization(TM) available to the vegetable oil refining industry on a worldwide basis.

CTi's Certificate notes that its five approved NanoReactors(TM) conform with test results confirmed by the U.S.-based laboratory's testing facility. F-Squared Laboratories, which conducted the tests, claims to have a management team with over 100 years of combined experience in EMC/Safety testing, RF, quality, design, and certifications. The Certificate was signed by CTi's CEO Roman Gordon on November 10th.

About CTi

CTi (OTCBB: CVAT; Frankfurt, Berlin & Stuttgart: WTC) is a technology research, development and technology company engaged primarily in the development of environmentally clean NanoReactor(TM) technologies and liquid process applications and solutions in various fields and industries, including vegetable oil processing and refining; renewable fuels; petroleum refining and petrochemicals; water and wastewater treatment; and the food and beverage industries.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

Manas Operational Update

BAAR, SWITZERLAND, November 16, 2010.

Manas Petroleum Corp. (“Manas”) (OTCBB: MNAP) is pleased to report that it has filed on EDGAR and on SEDAR its quarterly report on Form 10-Q for the third quarter of 2010. The complete document can be viewed at either www.sedar.com or www.sec.gov.

Results of Operations

Net income for the nine month period ended September 30, 2010 was $65,530,401 as compared to a net loss of $18,792,985 for the comparable period ended September 30, 2009. This increase is basically attributable to three components. Firstly, Manas realized a gain from the sale of its subsidiary in Albania of $57,850,918. Secondly, the value of Manas investment in associate, i.e. Petromanas Energy Inc., increased during this reporting period by $13,635,118. Thirdly, Manas had a charge of $10,592,637 during the nine months period ended September 30, 2009 due to changes in the fair value of warrants. For the nine month period ended September 30, 2010, Manas reported a gain of $533,223 due to changes in the fair value of warrants.

Operating expenses for the nine month period ended September 30, 2010 decreased to $6,099,437 from $7,426,013 reported for the same period in 2009. This is a decrease of 18% or $1,326,576. This decrease is mainly attributable to lower personnel costs and lower administrative costs.

Liquidity and Capital Resources

The company’s cash balance as of September 30, 2010 was $3,318,465. Total current assets as of September 30, 2010 amounted to $3,986,616 and total current liabilities were $428,543 resulting in a net working capital of $3,558,073. In addition, of the 200,000,000 common shares of Petromanas Energy Inc. held by Manas, 25,000,000 were freely tradable as of September 30, 2010. On September 30, 2010, the market value of these freely tradable shares was $8,750,000.

Going Concern

The consolidated financial statements have been prepared on the assumption that we will continue as a going concern.

For the three and nine month periods ended September 30, 2010, Manas had net income of $9,618,213 and $65,530,401, respectively. The net income for the three months period ended September 30, 2010 was mainly attributable to an increase in the fair value of the company’s investment in Petromanas Energy Inc. which accounted for $10,700,583. For the nine months period ended September 30, 2010 net income was mainly attributable to the gain from sale of a subsidiary of $57,850,918 and the subsequent increase in fair value of this investment of $13,653,118.

Accumulated net loss since inception until September 30, 2010 was $218,475. Accumulated cash flows used in operating activities from inception until September 30, 2010 amounted to $30,706,027. The cash balance as of September 30, 2010 was $3,318,465. Total current assets as of September 30, 2010 amounted to $3,986,616 and total current liabilities were $428,543 resulting in a net working capital of $3,558,073.

Management has projected that Manas will need $8,280,000 to fund its projected operations over the next 12 months and that, between net working capital and its shares of Petromanas, it does not expect that it will need additional funding from external sources to cover its commitments until October 2011. However, in order to continue operations beyond October 2011 and execute on its strategy to develop its assets, Manas believes that it will require further funds.

Recent Developments

Albania

During the first nine months of 2010, Petromanas Energy Inc., in which Manas holds a 32.29% interest, continued its exploration activities in Albania:

The technical seismic acquisition of 105 km in block E in Albania was completed on November 10, 2010. This was to further determine the structural definition of the West Rova, Rova and Papri prospects and adds to around 1,300 km of existing seismic previously acquired by Albpetrol and Coparex and partially reprocessed by DWM Petroleum AG. The new seismic fulfils the minimum work commitment of the first exploration period of the production sharing contract for blocks D and E.

In addition Petromanas Energy has prepared a seismic program for blocks 2 and 3 in order to further determine the structural definition of the South Shpiragu 1, South Shpiragu 2 prospects and the Krasi lead.

The new seismic in blocks 2 and 3 will be tied to the existing Shpiragu well in order to allow a timedepth

correlation of the South Shpiragu prospects.

Kyrgyz Republic

The closed Joined Stock Company “South Petroleum Company”, in which Manas holds a 25% participating interest, continued its geological studies within its five license areas. During the third quarter 2010 technical interpretation work was focused on:

-DANK Tuzluk reprocessing and integration of 2010 seismic acquisition, and mapping in the Chkalovsk and North Auchi prospect areas

-Regional mapping of the Tajik acreage, with overlap into the Tuzluk permit area

The highlights of the activity in the Bishkek office during the third quarter 2010 include:

-No health and safety incidents

-Ongoing work on administration of SPC offices both in Bishkek and Jalalabat;

-Communication with Ministry of Geology and Governor of Batken oblast;

-Contracted DANK LLC for reprocessing of seismic data (Tuzluk and Soh permits);

-Digitizing old geological data: old drilling reports and seismic data;

-Integration of present geological and geophysical data;

-Drilling planning:

-Reviewing all previous services and supply contracts for conformity and use in the year 2011;

-Working through the supply routes: Kazakhstan, China to Kyrgyzstan, etc.;

-Customs clearance processes and procedures requirements;

-Reviewing and commenting on the new draft laws on Subsoil, Licensing, Somon Oil PSA, etc.;

-Reviewing tax legislation and applicability to SPC operations;

-Support in preparation of the draft PSA for Somon-Tajik;3

-Support in meetings held in Dushanbe on the PSA: translation of documents and meetings;

-General overview and analysis of the current political situation in the Kyrgyz Republic;

-Registered all SPC license agreements with the local Land Registrar offices. Precautious measure;

-Preparing letters and submittals to the Ministry of Geology for deferral of SPC work commitments for 2010 due to instability in the country;

-Commenced preparation of SPC’s annual report to the Ministry of Geology on all of SPC’s license areas

-Management of 2010 drilling suspension, chiefly related to cost control of in-country drilling management consultancies Tajikistan Somon Oil, in which Manas Petroleum holds a 90% interest, continued its activities during the third quarter 2010. These activities include:

Tajikistan

Somon Oil, in which Manas Petroleum holds a 90% interest, continued its activities during the third quarter 2010. These activities include:

-Safety: Zero lost time injuries

-Technical database compilation and integration ongoing.

-Draft Production Sharing Agreement finalized and forwarded to Tajik Government

-Meetings held with the Tajik Ministry of Energy and the Geology Agency.

-No seismic acquisition activity

-Processing of complete 468.6 km, 40% completed

-Processing project included reprocessing of ~120km 2007-2008 seismic into 2010 dataset in southern license area is ongoing.

-Interpretation and integration of new seismic into Mapping proceeding; completion of final mapping and prospect and lead definition scheduled for end October

-2011 Seismic Project discussions held with potential operators and survey specifications being discussed

-Chkalovsk technical description provided to Somon Oil for drilling.

-Project synthesis in Dushanbe

-Scouting of Proposed Drill Locations (Chkalovsk #1, North Auchi #1, Macatau #1)

-Drill well planning for Chkalovsk #1 (prop), North Auchi #1 (prop):

o Geological and Geophysical Prognosis

o Preliminary Engineering Well Design

o Preliminary Well Budget

Seismic data quality is generally good to excellent. Objectives relating to definition (to drill ready status) of the Chkalovsk and North Auchi prospects is likely to be met following final processing and mapping, on current indications.

Objectives relating to lead definition in the West Digmai area appear disappointing at this stage, however, the same part of the dataset is encouraging with respect to the Yangiabad - Maiti areas (additional prospectively). Lines additional to the initial program in the northwest license area are of very good quality (field data and initial stacks) and have been highly valuable in terms of the contribution to understanding of the technical issues and prospectively in the area.

Chile

Pursuant to an agreement dated January 29, 2010, we agreed to assign our interest in our Chilean project in exchange for a return of all of the operational costs that we have invested in this project to date and relief from all currently outstanding and future obligations in respect of the project. The transfer of our participation in this Chilean project to the new owners has been approved by the Chilean ministry and is now subject to approval by the new parties.

Mongolia

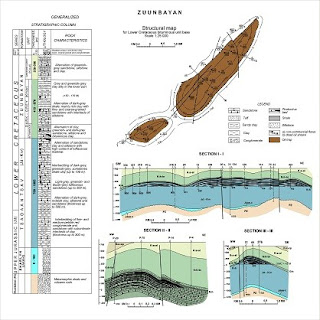

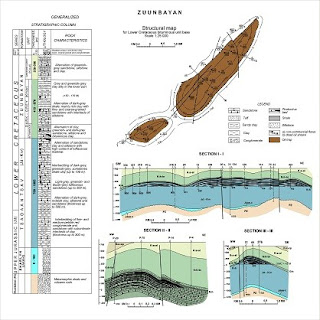

A team of geologists and geophysicists from the company’s Ulan Bator office has initiated the reinterpretation

of existing geological data and is planning an upcoming gravity survey. This is to further define the location of lines for the seismic campaign on blocks 13 and 14 which will consist of around 300 linear km. A plan for environmental protection and restoration to be approved by the Ministry of Environment is currently being prepared.

Data from total 451 existing wells drilled in Zuunbayan and Tsagaan Els oil fields area and in prospects were collected. All well data was translated from Russian and Mongolian into English for analysis by international experts.

On November 10, 2010, Manas announced the completion of the 2010 seismic acquisition program for block 13 and 14. The company intends to use the additional 300 km of 2D seismic data to improve its technical database and its chance of drilling a successful exploration well. After interpretation of the full dataset, it intends to decide whether it is ready to drill one or more exploration wells or acquire 3D seismic to define the drill prospects in better detail. Depending on this decision, Manas hopes to spud the first well in 2011.

About Manas Petroleum Corp.

Manas Petroleum is an international oil and gas company with primary focus on exploration and development in South-Eastern Europe, Central Asia and Mongolia. In Albania, Manas participates in a 1.7 million acre exploration project through its equity interest in Petromanas Energy Inc., a Canadian public company. In Kyrgyzstan, Manas has signed a US $54 million farm-out agreement with Santos International Holdings Pty Ltd., a subsidiary of Australia's third largest oil and gas company. In addition to the development of its Kyrgyzstan project, Santos is developing the company's neighboring Tajikistan license under an option farm out agreement. In Mongolia, Manas owns record title to the two Production Sharing Contracts covering Blocks XIII and XIV through its wholly-owned subsidiary DWM Petroleum AG, but 26% of the beneficial ownership interest in these blocks is held in trust for

others.

Undiscovered Equities is currently offering a trial subscription. For more information please call 1-800-404-8982 or visit our website at www.undiscoveredequities.com

Sincerely,

Kevin McKnight

101 Plaza Real South, Suite 212

Boca Raton, FL 33432

1-800-404-8982

www.undiscoveredequities.com

Manas Petroleum Corp. (“Manas”) (OTCBB: MNAP) is pleased to report that it has filed on EDGAR and on SEDAR its quarterly report on Form 10-Q for the third quarter of 2010. The complete document can be viewed at either www.sedar.com or www.sec.gov.

Results of Operations

Net income for the nine month period ended September 30, 2010 was $65,530,401 as compared to a net loss of $18,792,985 for the comparable period ended September 30, 2009. This increase is basically attributable to three components. Firstly, Manas realized a gain from the sale of its subsidiary in Albania of $57,850,918. Secondly, the value of Manas investment in associate, i.e. Petromanas Energy Inc., increased during this reporting period by $13,635,118. Thirdly, Manas had a charge of $10,592,637 during the nine months period ended September 30, 2009 due to changes in the fair value of warrants. For the nine month period ended September 30, 2010, Manas reported a gain of $533,223 due to changes in the fair value of warrants.

Operating expenses for the nine month period ended September 30, 2010 decreased to $6,099,437 from $7,426,013 reported for the same period in 2009. This is a decrease of 18% or $1,326,576. This decrease is mainly attributable to lower personnel costs and lower administrative costs.

Liquidity and Capital Resources

The company’s cash balance as of September 30, 2010 was $3,318,465. Total current assets as of September 30, 2010 amounted to $3,986,616 and total current liabilities were $428,543 resulting in a net working capital of $3,558,073. In addition, of the 200,000,000 common shares of Petromanas Energy Inc. held by Manas, 25,000,000 were freely tradable as of September 30, 2010. On September 30, 2010, the market value of these freely tradable shares was $8,750,000.

Going Concern

The consolidated financial statements have been prepared on the assumption that we will continue as a going concern.

For the three and nine month periods ended September 30, 2010, Manas had net income of $9,618,213 and $65,530,401, respectively. The net income for the three months period ended September 30, 2010 was mainly attributable to an increase in the fair value of the company’s investment in Petromanas Energy Inc. which accounted for $10,700,583. For the nine months period ended September 30, 2010 net income was mainly attributable to the gain from sale of a subsidiary of $57,850,918 and the subsequent increase in fair value of this investment of $13,653,118.

Accumulated net loss since inception until September 30, 2010 was $218,475. Accumulated cash flows used in operating activities from inception until September 30, 2010 amounted to $30,706,027. The cash balance as of September 30, 2010 was $3,318,465. Total current assets as of September 30, 2010 amounted to $3,986,616 and total current liabilities were $428,543 resulting in a net working capital of $3,558,073.

Management has projected that Manas will need $8,280,000 to fund its projected operations over the next 12 months and that, between net working capital and its shares of Petromanas, it does not expect that it will need additional funding from external sources to cover its commitments until October 2011. However, in order to continue operations beyond October 2011 and execute on its strategy to develop its assets, Manas believes that it will require further funds.

Recent Developments

Albania

During the first nine months of 2010, Petromanas Energy Inc., in which Manas holds a 32.29% interest, continued its exploration activities in Albania:

The technical seismic acquisition of 105 km in block E in Albania was completed on November 10, 2010. This was to further determine the structural definition of the West Rova, Rova and Papri prospects and adds to around 1,300 km of existing seismic previously acquired by Albpetrol and Coparex and partially reprocessed by DWM Petroleum AG. The new seismic fulfils the minimum work commitment of the first exploration period of the production sharing contract for blocks D and E.

In addition Petromanas Energy has prepared a seismic program for blocks 2 and 3 in order to further determine the structural definition of the South Shpiragu 1, South Shpiragu 2 prospects and the Krasi lead.

The new seismic in blocks 2 and 3 will be tied to the existing Shpiragu well in order to allow a timedepth

correlation of the South Shpiragu prospects.

Kyrgyz Republic

The closed Joined Stock Company “South Petroleum Company”, in which Manas holds a 25% participating interest, continued its geological studies within its five license areas. During the third quarter 2010 technical interpretation work was focused on:

-DANK Tuzluk reprocessing and integration of 2010 seismic acquisition, and mapping in the Chkalovsk and North Auchi prospect areas

-Regional mapping of the Tajik acreage, with overlap into the Tuzluk permit area

The highlights of the activity in the Bishkek office during the third quarter 2010 include:

-No health and safety incidents

-Ongoing work on administration of SPC offices both in Bishkek and Jalalabat;

-Communication with Ministry of Geology and Governor of Batken oblast;

-Contracted DANK LLC for reprocessing of seismic data (Tuzluk and Soh permits);

-Digitizing old geological data: old drilling reports and seismic data;

-Integration of present geological and geophysical data;

-Drilling planning:

-Reviewing all previous services and supply contracts for conformity and use in the year 2011;

-Working through the supply routes: Kazakhstan, China to Kyrgyzstan, etc.;

-Customs clearance processes and procedures requirements;

-Reviewing and commenting on the new draft laws on Subsoil, Licensing, Somon Oil PSA, etc.;

-Reviewing tax legislation and applicability to SPC operations;

-Support in preparation of the draft PSA for Somon-Tajik;3

-Support in meetings held in Dushanbe on the PSA: translation of documents and meetings;

-General overview and analysis of the current political situation in the Kyrgyz Republic;

-Registered all SPC license agreements with the local Land Registrar offices. Precautious measure;

-Preparing letters and submittals to the Ministry of Geology for deferral of SPC work commitments for 2010 due to instability in the country;

-Commenced preparation of SPC’s annual report to the Ministry of Geology on all of SPC’s license areas

-Management of 2010 drilling suspension, chiefly related to cost control of in-country drilling management consultancies Tajikistan Somon Oil, in which Manas Petroleum holds a 90% interest, continued its activities during the third quarter 2010. These activities include:

Tajikistan

Somon Oil, in which Manas Petroleum holds a 90% interest, continued its activities during the third quarter 2010. These activities include:

-Safety: Zero lost time injuries

-Technical database compilation and integration ongoing.

-Draft Production Sharing Agreement finalized and forwarded to Tajik Government

-Meetings held with the Tajik Ministry of Energy and the Geology Agency.

-No seismic acquisition activity

-Processing of complete 468.6 km, 40% completed

-Processing project included reprocessing of ~120km 2007-2008 seismic into 2010 dataset in southern license area is ongoing.

-Interpretation and integration of new seismic into Mapping proceeding; completion of final mapping and prospect and lead definition scheduled for end October

-2011 Seismic Project discussions held with potential operators and survey specifications being discussed

-Chkalovsk technical description provided to Somon Oil for drilling.

-Project synthesis in Dushanbe

-Scouting of Proposed Drill Locations (Chkalovsk #1, North Auchi #1, Macatau #1)

-Drill well planning for Chkalovsk #1 (prop), North Auchi #1 (prop):

o Geological and Geophysical Prognosis

o Preliminary Engineering Well Design

o Preliminary Well Budget

Seismic data quality is generally good to excellent. Objectives relating to definition (to drill ready status) of the Chkalovsk and North Auchi prospects is likely to be met following final processing and mapping, on current indications.

Objectives relating to lead definition in the West Digmai area appear disappointing at this stage, however, the same part of the dataset is encouraging with respect to the Yangiabad - Maiti areas (additional prospectively). Lines additional to the initial program in the northwest license area are of very good quality (field data and initial stacks) and have been highly valuable in terms of the contribution to understanding of the technical issues and prospectively in the area.

Chile

Pursuant to an agreement dated January 29, 2010, we agreed to assign our interest in our Chilean project in exchange for a return of all of the operational costs that we have invested in this project to date and relief from all currently outstanding and future obligations in respect of the project. The transfer of our participation in this Chilean project to the new owners has been approved by the Chilean ministry and is now subject to approval by the new parties.

Mongolia

A team of geologists and geophysicists from the company’s Ulan Bator office has initiated the reinterpretation

of existing geological data and is planning an upcoming gravity survey. This is to further define the location of lines for the seismic campaign on blocks 13 and 14 which will consist of around 300 linear km. A plan for environmental protection and restoration to be approved by the Ministry of Environment is currently being prepared.

Data from total 451 existing wells drilled in Zuunbayan and Tsagaan Els oil fields area and in prospects were collected. All well data was translated from Russian and Mongolian into English for analysis by international experts.

On November 10, 2010, Manas announced the completion of the 2010 seismic acquisition program for block 13 and 14. The company intends to use the additional 300 km of 2D seismic data to improve its technical database and its chance of drilling a successful exploration well. After interpretation of the full dataset, it intends to decide whether it is ready to drill one or more exploration wells or acquire 3D seismic to define the drill prospects in better detail. Depending on this decision, Manas hopes to spud the first well in 2011.

About Manas Petroleum Corp.